The number of US citizens getting scammed online annually has been increasing. In 2022, more than $9 billion was lost to various online scams. This number has jumped to more than $10 billion in 2023. According to the investigation, one out of every four people gets defrauded, with a typical loss of $500 from fraudulent activities.

These numbers are bound to be higher than those reported, as many refrain from reporting them to the higher authorities. Many do not know how to report a scammer, while most avoid reporting as they feel the guilt and shame that they might feel when they confess to being victims of a fraudulent activity.

It is important to report scams, no matter how small the amount, as there are high chances of recovering them when reported at an early stage. Another factor is that it is your hard-earned money, and letting some scammers run away with it only encourages them to continue engaging in such practices.

As we are moving towards paperless currency into digital currency, it becomes more apparent that reporting such online fraud to the higher authorities. Alerting them of a scam will help them draft rules and regulations that will protect the financial interests of citizens, and strong actions will help combat the online menace caused by scammers.

If You’ve Paid A Scammer

As we mentioned, it is important to report fraud, and there are a few steps to follow that will help report such fraud actively and correctly.

Credit Card or Debit Card

If you have used your credit card or debit card, then contact your bank or the company that has issued the card. Tell them about the scam and ask them to reverse the transaction. Such steps will ensure that no further amount will be transferred to the scammer’s account.

Bank Transfer

If you recognize that there has been an unauthorized transfer or if you fail to recognize any account that is requesting money, then contact your bank immediately. Alert your bank regarding the unauthorized transfer of your financial funds and request that they reverse them.

Gift Cards

Scammers sometimes demand payment through gift cards. When you realize that you have been scammed, contact the company that issued the gift card and tell them about the scam. Request them, that they halt the transfer and reverse it.

Wire Transfer

Wire transfer is very popular with scammers while carrying out scams. When you suspect that you have sent money to a scammer, then contact the wire transfer company and tell them about the scam. Request that they reverse the transaction and return the money to you.

Wire Transfer Through Bank

If you suspect that the financial asset has been wire-transferred through the bank, then contact the bank and request a reversal of the transaction. Tell them about the scam while requesting the reversal of the transaction.

Money Transfer Through App

Get in touch with the company behind the money transfer app and tell them about the scam while asking for a reversal of the transaction. Get in touch with the bank or the company that has provided you with a credit or debit card that has been used while transferring the money. Give them the details of the scam and ask for a reversal of the transaction.

Cryptocurrency

You have to be careful while sending cryptos to the correct wallet address. It is challenging to reverse a cryptocurrency transaction. When you feel that you have been victimized by a crypto scam, contact the crypto exchange or the platform used to transfer your crypto.

Sending Cash

If you have used some other postal service for sending money, then contact the service provider and request that they intercept the package. Tell them that you have fallen victim to a scam.

You’re Scammed, And The Scammer Has Your Personal Information

There is a high chance that you have provided the scammers with sensitive information that you may never choose to divulge, even to your close ones. If you are wondering how to report a scam after you have divulged your sensitive information, then follow these steps:

Social Security Number

If you have provided your social security number to scammers, check online if your social security number has been compromised. Take the necessary steps to safeguard your financial interests by changing your account passwords.

Username and Password

If you have provided scammers with your username and password, then immediately change your password. Create a strong password, and if possible, try to use the multi-factor authentication feature to further deter scammers from accessing your account.

The Scammer Has Hacked Your Phone Or Your Computer

There is a high chance that scammers and hackers may have hacked into your smartphone or computer. Follow these steps if you have contacted scammers through these electronic devices.

Remote Access to Your Computer

Update your computer’s firmware and install and update a good antivirus program on your computer. Run a scan on your computer and check for any malware. The antivirus may isolate and remove the malicious application. You must take important steps to protect your personal information.

Smartphone And Account Hacked

You must contact your smartphone number service provider and tell them about the scam. Request to transfer the authority back to you. Once you have your smartphone number authority back to you, change all the account passwords. Create a strong password and use multi-factor authentication features for added security.

Open your financial accounts and check for any unauthorized activity. If you find one, report it to the authorities immediately.

Bought Something From A Scammer

The internet is teeming with scammers, and the chances of you buying something from a scammer online are very high. If you think that you have bought something from a scammer, then follow these steps:

Bought Through Credit, Debit Card, Or PayPal

If you have purchased a product or service online through a debit or credit card and have not received it, you can always request a chargeback. A chargeback is a facility that will allow the buyer to receive the entire paid amount for a product or service if they receive something else that was promised online, a substandard product, or fail to receive it.

You can also claim a chargeback if you have purchased a product or service online through a PayPal account.

Bank Transfer Or Direct Debit

You must report a scam to the relevant authorities when you realize that you have been scammed. You can always ask your bank about Authorized Push Payment (APP) fraud. Under APP fraud, if you have unknowingly transferred money to scammers, the transaction will be reversed. For this, you need to contact your bank and tell them about the fraud.

You can also claim a Direct Debit Guarantee (DDG), if you have used your debit card to transfer your money, unknowingly, into a scammer’s account.

If you fail to receive your money even after requesting it through the APP fraud and DDG facilities, then pursue the matter through the bank’s official complaint channels. Even if, after 8 weeks, you are still not refunded or have not received an official letter, try to contact the Consumer Financial Protection Bureau Ombudsman.

Money Transfer Through Bank or App

If you have used a wire transfer app or directly transferred funds using your bank account, then contact the bank and request a reversal of the transaction. You can avail of these services if you feel that you have fallen victim to a scam.

Voucher and Gift Cards

There is a low probability of recovering money if you have paid them through vouchers and gift cards. You can recover them quickly if you discover the deception at the early stage of the scam. You can get in touch with the company issuing vouchers and gift cards. You need to confirm with them that you have been scammed and that you paid the scammer through vouchers and gift cards.

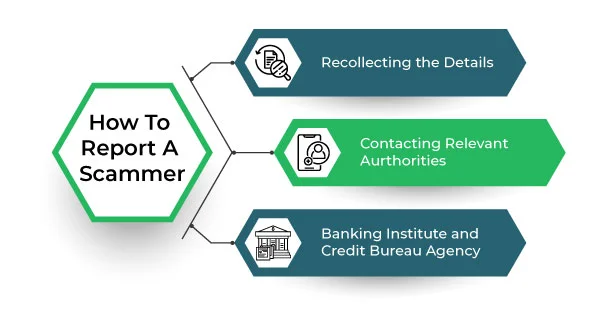

How To Report A Scammer

It is important to report a scam artist to the relevant authorities; it serves several purposes: it alerts the higher authorities of the latest scam, provides awareness in society, and allows higher authorities to recognize the scam and take adequate steps to protect the financial interests of their citizens.

Recollecting the Details

- When you realize that you have been scammed, do not destroy anything that is related to the scammer.

- Sever all ties with the scammers and do not entertain their phone calls, messages, and texts.

- Write down all the details regarding the platform and media used to contact you.

- Visit the website and mention all the details about their headquarters address, branch address, contact details, emails, and other social media presence.

- Save all the correspondence that was shared by the scammer, including charts, graphs, texts, messages, screenshots, and so forth.

Contacting Relevant Aurthorities

- Visit your local police department and file a complaint with them. Provide all the details that you have collected regarding the scam; it will save a lot of time.

- Contact the FBI’s Internet Crime Complaint Center, or IC3, and report the online scam.

- Contact the district and state general attorneys and file a civil case against the scammers involved in the scam.

- Contact the Federal Trade Commission, or FTC, and provide them with the details of the scam.

Banking Institute and Credit Bureau Agency

- Visit your bank and tell them about the fraudulent activity; contact your credit bureau agency; and ask for a free annual report.

- Request that they freeze your financial accounts until the investigation is completed.

- Go through the report and look for any unauthorized entries or suspicious activities. Report to the bank and credit bureau when you find one.

Once you have filed the complaint, you will need to get in touch with all these departments to know the progress of your case.

Final Thoughts

Alternatively, you can approach us at Capx Recovery and report the scam. We specialize in financial asset recovery with the primary aim of safeguarding the financial interests of victims of an online scam by recovering and returning them to their rightful owners.

Our team of specialized financial forensic and international financial law experts is diligent and dedicated to recovering financial assets lost to an online scam. Our experts have years of experience and the necessary know-how to engage with third parties like banks, and financial and crypto exchanges, and simultaneously strategize the best possible plan to maximize the recovery of the financial assets.

Contact us today and have a word with our experts, who will analyze and evaluate your case and provide you with an optimistic recovery plan.